Video

Who is fintuity in 2 minutes

Analyse, manage, consolidate or transfer your pension savings with fintuity

We can help you with

Pension Locator

We will begin by reviewing your existing financial and pensions provision and then locate the best pension product for you.

Planning

Planning for your retirement has never been more important. We can help you plan for every eventuality with our in-depth and entirely bespoke planning service.

Review

If you are looking to develop a new portfolio or amend an existing one, we can provide you with a fully bespoke investment roadmap to help maximise your returns.

Consolidate Pension Plans

If you have more than one pension, our experienced team is able to consolidate your pension plans into one easy to access plan.

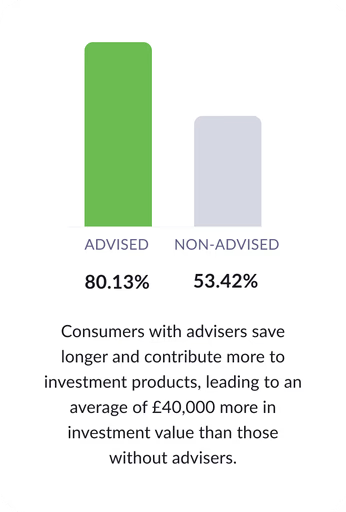

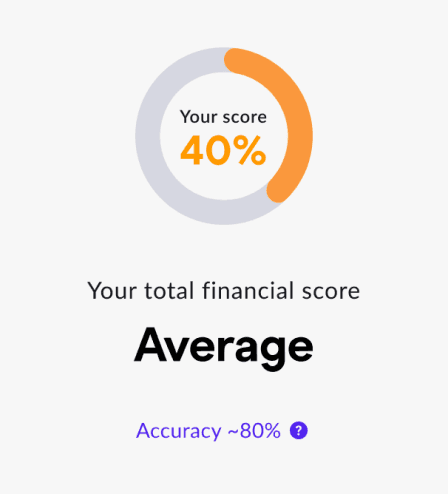

How we can help you with the right financial advice

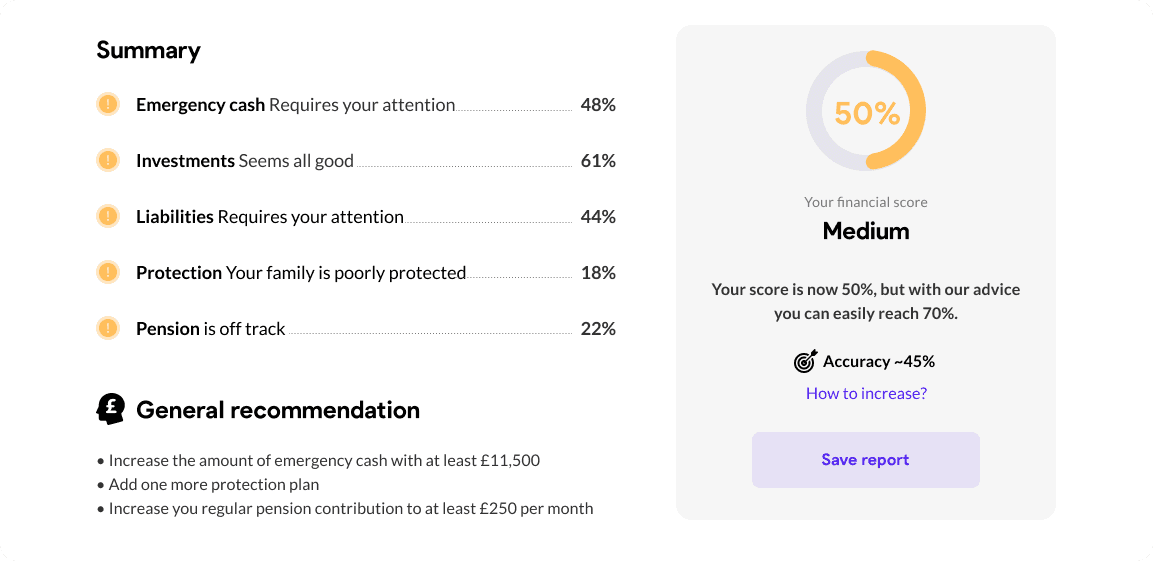

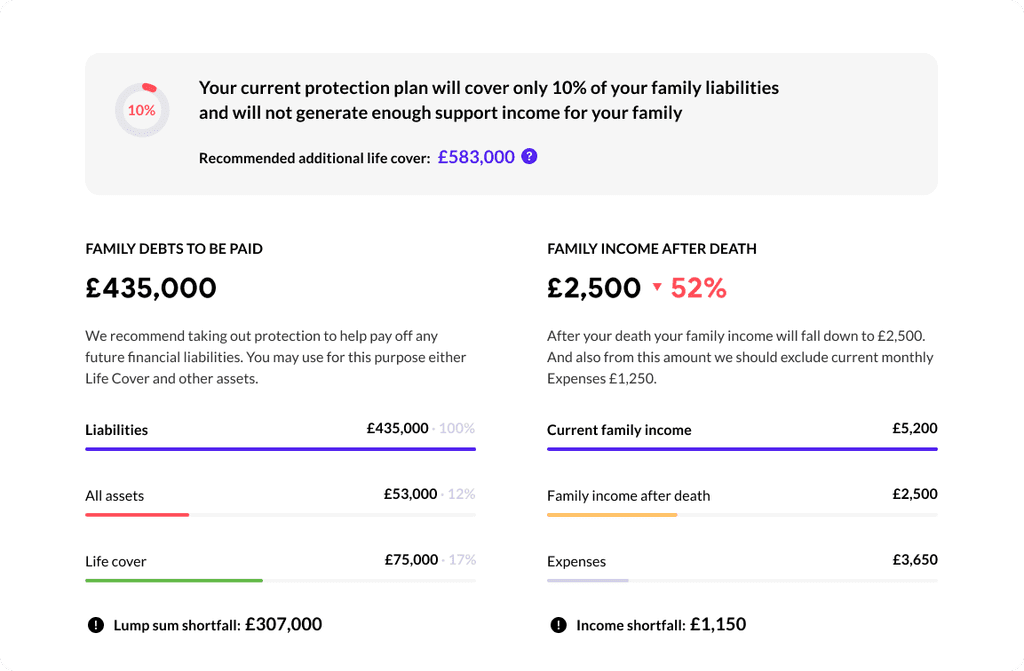

Receiving expert financial advice is crucial to making the right investment decision. With the right support and advice from a regulated Independent Financial Adviser (IFA), you will be able to make the right investment decisions that match your personal financial circumstances. Your IFA will help to explain possible options open to you as well as the details of suitable financial products and investment strategies.

Constantly updated, we are also delighted to offer the latest tips and guidance through our Investment Knowledge Base.

PRE-RETIREMENT

Get ahead of the curve and plan your future retirement income now

It is not uncommon in the UK for people to have their pension plans set by individual previous employers. Whilst great at the time, this can often lead to having a portfolio of 3-5 pensions held in separate accounts with different providers.

Holding multiple pension pots with different providers that you might not have selected or reviewed personally can lead to a disjointed approach to managing your portfolio and requires much time and energy to ensure that the portfolio continues to work for you.

Fintuity’s professional advisers can help you by reviewing you pensions plans in depth – we will start by analysing the performance of the current provider(s) as well as their fees and make a sound recommendation as to how to get the most back from your pension contributions.

AT-RETIREMENT

We can help you to make the right decisions for your pensions

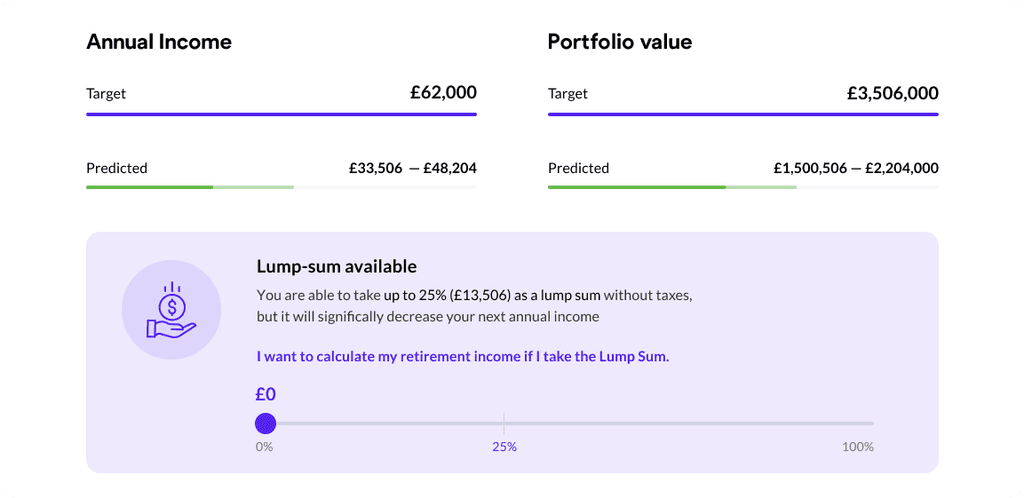

How would you like to receive your pensions upon retirement? We can outline in detail the options open to you, which includes:

Receive the pension in one cash payout and use for whatever you wish. Whilst a tempting option this may incur additional tax payments.

Buy an annuity to generate a guaranteed income throughout the whole of your life.

Use a flexi-drawdown option to withdraw as much income as you need every year, but keep the rest invested.

Our advisors are qualified to help you understand your retirement goals and explain every available option in great detail, providing an actionable plan.

Your initial discussion is complimentary and this will help us to understand your financial needs

Initial meeting ~15 minutes

About Fintuity

Founded in 2017, Fintuity is a fully digital and FCA regulated Independent Financial Adviser (IFA) that provides a range of services via our proprietary online platform. Fintuity is a wholly online, secure and cutting edge platform that delivers compliant and bespoke advice at below-industry rates.

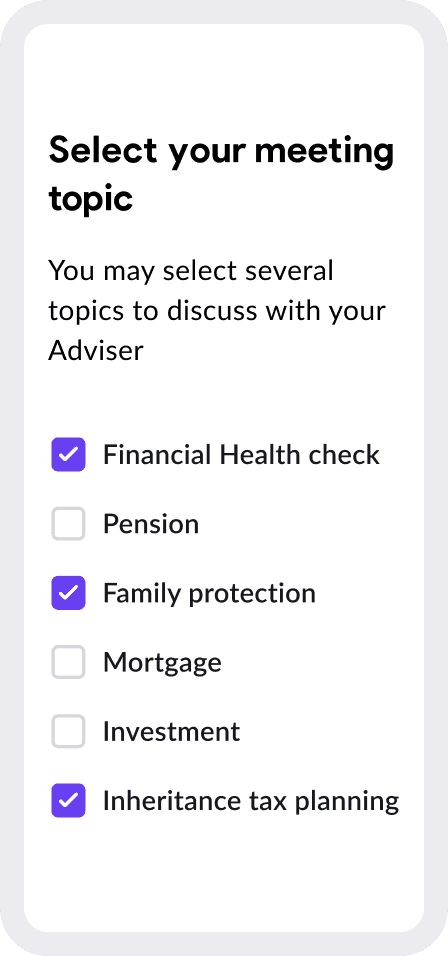

Book a free consultation

Your first consultation is completely free of

charge - all you need to do is to select a

convenient time & date and outline how we can

assist you.