Let Fintuity Financial Wellbeing help you to

achieve your financial goals

Let Fintuity Financial

Wellbeing help you to

achieve your financial goals

Let Fintuity Financial Wellbeing help you to

achieve your financial goals

Financial problems reduce focus, impact mental health and cause stress. It’s something we rarely get taught but working with Fintuity Financial Wellbeing coaches can help you achieve your personal financial goals with confidence!

Financial problems reduce focus, impact mental health and cause stress. It’s something we rarely get taught but working with Fintuity Financial Wellbeing coaches can help you achieve your personal financial goals with confidence!

Financial problems reduce focus, impact mental health and cause stress. It’s something we rarely get taught but working with Fintuity Financial Wellbeing coaches can help you achieve your personal financial goals with confidence!

Your financial health is key to building the life you want

1 in 3

people feel underpaid

73%

of people wished they could access financial information in a simple manner

44%

of people worry about their personal finances at least once a week

Your financial health is key to building the life you want

1 in 3

people feel underpaid

73%

of people wished they could access financial information in a simple manner

44%

of people worry about their personal finances at least once a week

Your financial health is key to building the life you want

1 in 3

people feel underpaid

73%

of people wished they could access financial information in a simple manner

44%

of people worry about their personal finances at least once a week

Elevate your employees' financial confidence with Fintuity Financial Wellbeing Service, supported by our regulated financial experts across the UK.

With a legacy of demystifying financial complexities, our subscription service is the key to their financial peace of mind

Elevate your employees' financial confidence with Fintuity Financial Wellbeing Service, supported by our regulated financial experts across the UK.

With a legacy of demystifying financial complexities, our subscription service is the key to their financial peace of mind

Elevate your employees' financial confidence with Fintuity Financial Wellbeing Service, supported by our regulated financial experts across the UK.

With a legacy of demystifying financial complexities, our subscription service is the key to their financial peace of mind

How it works

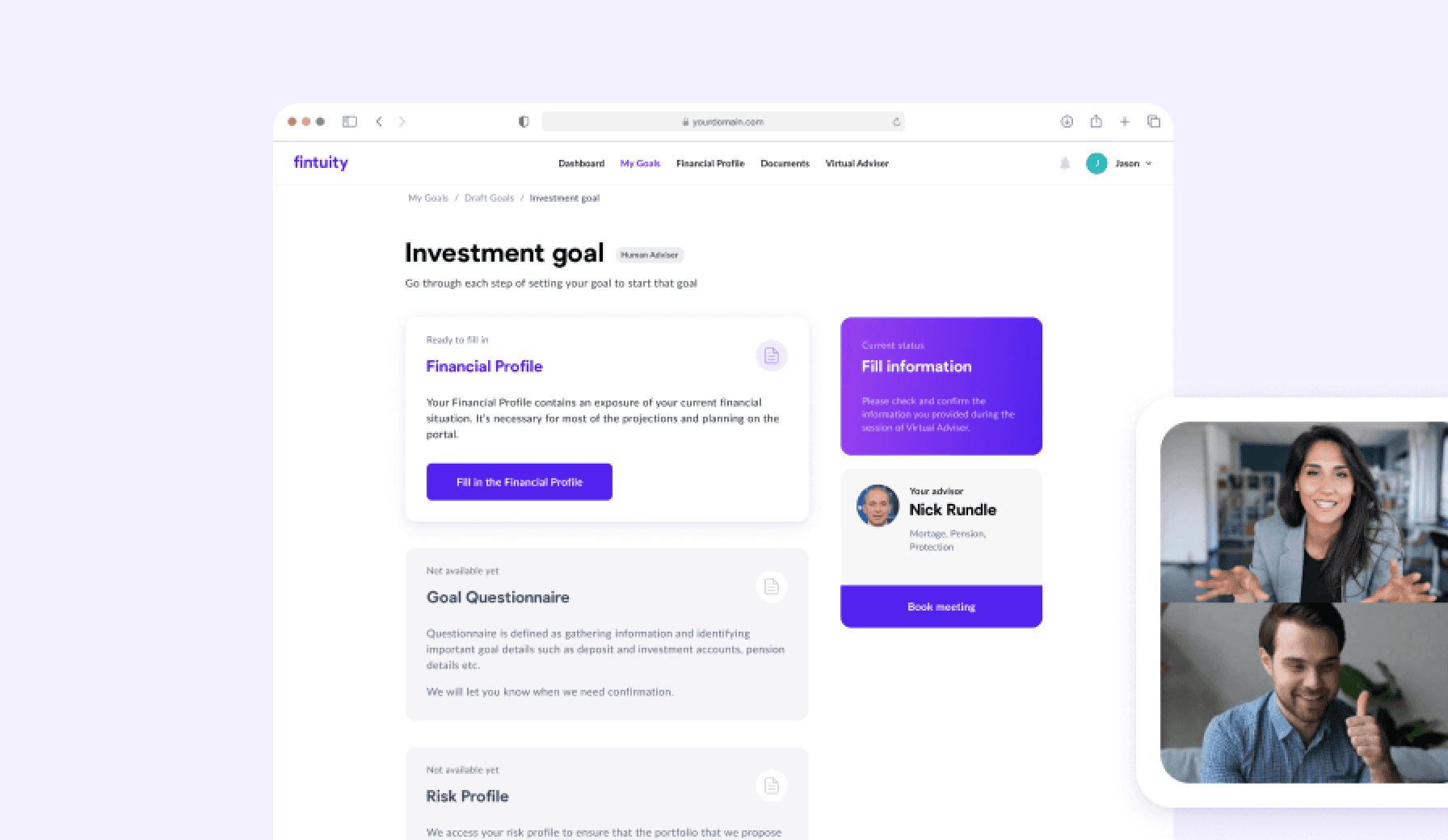

You meet with you

own money expert

Everyone, across all levels, gets matched with your own expert for confidential video sessions.

They’ll discuss your financial goals and coach you on how to achieve those goals. Alongside quarterly check-in meetings & annual reviews your coach is always in contact when questions come up.

1

2

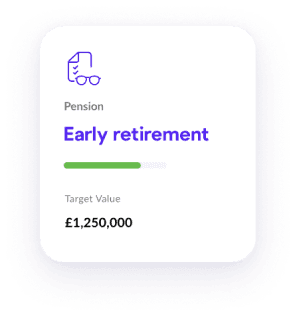

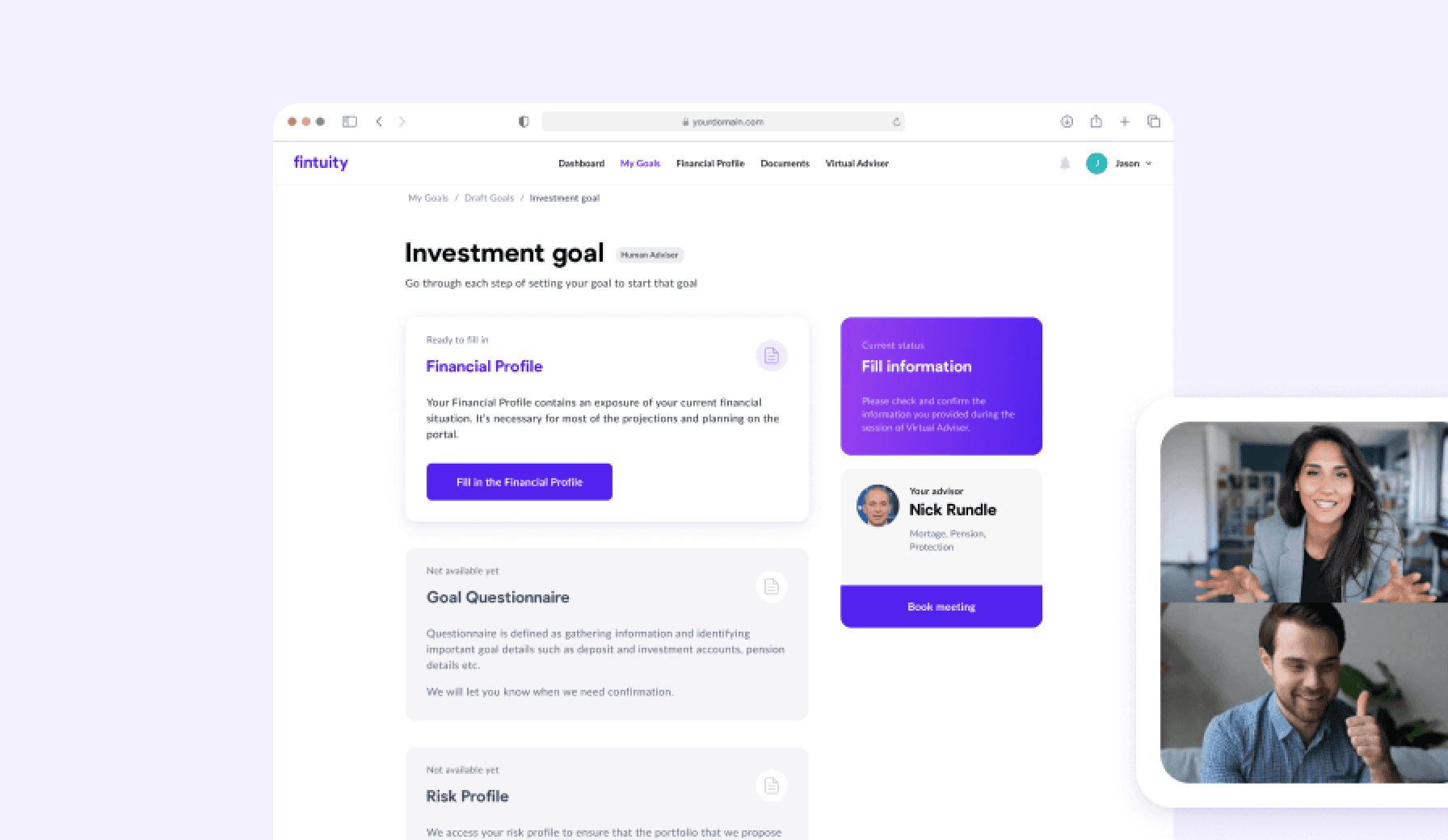

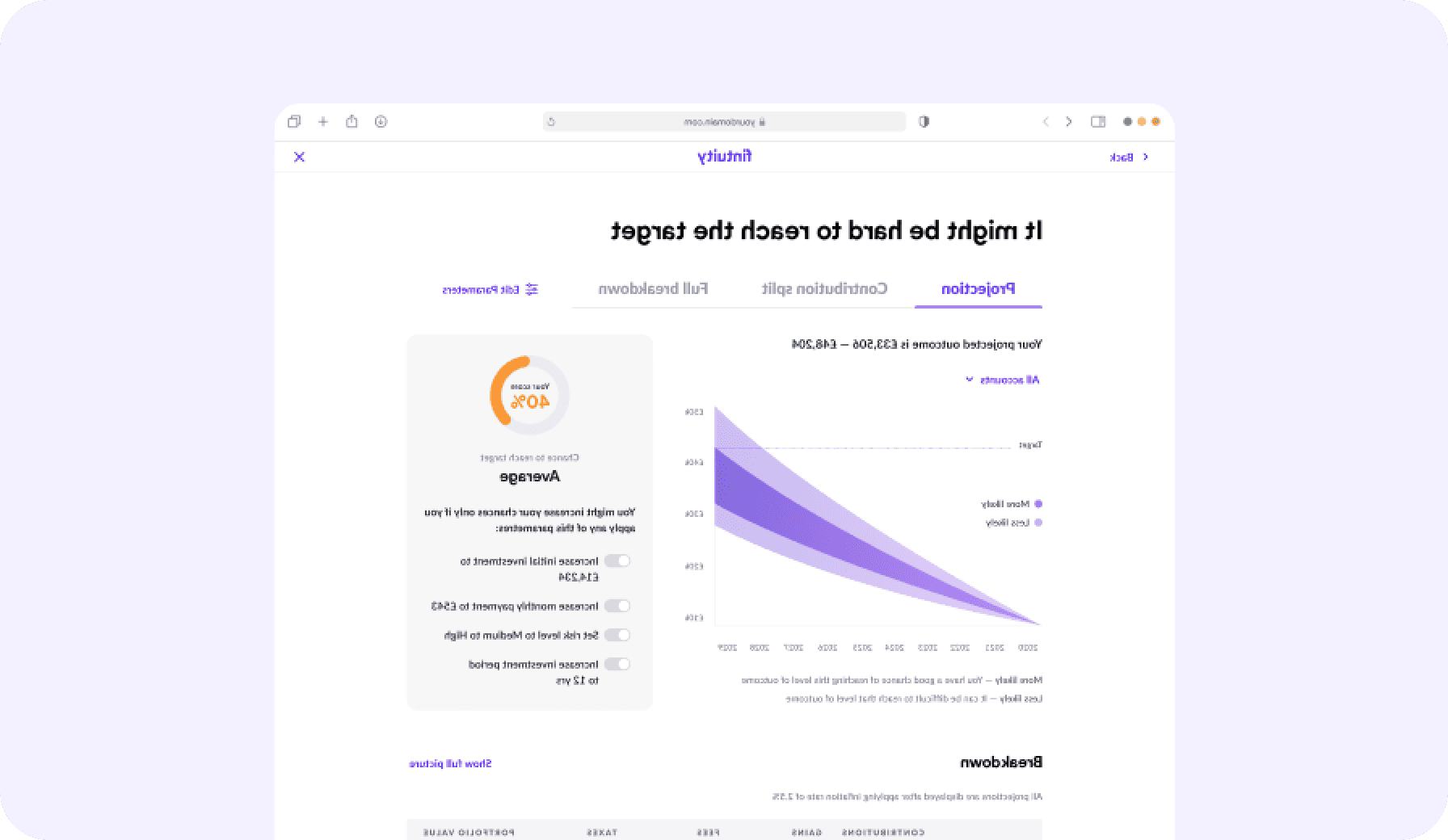

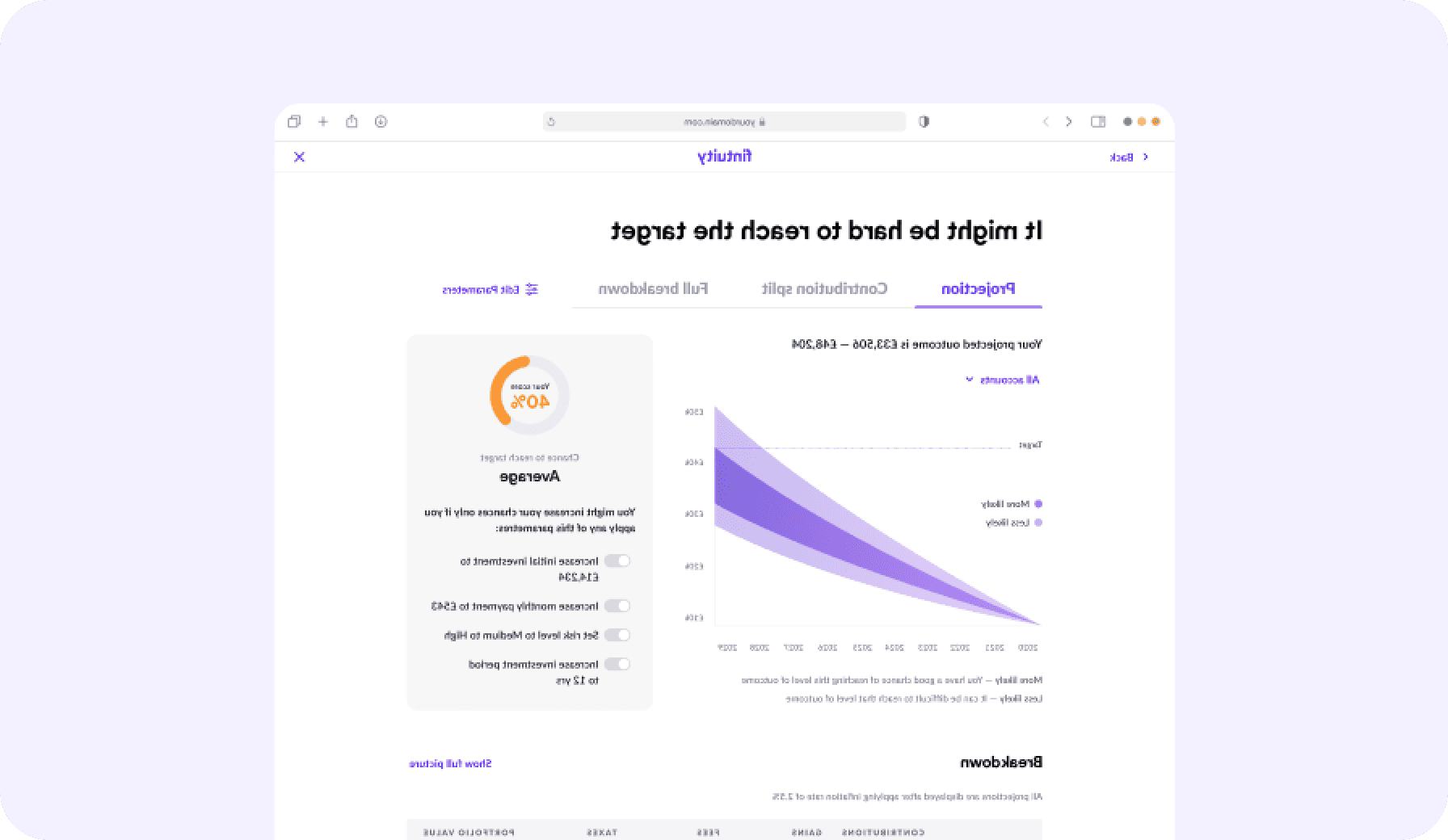

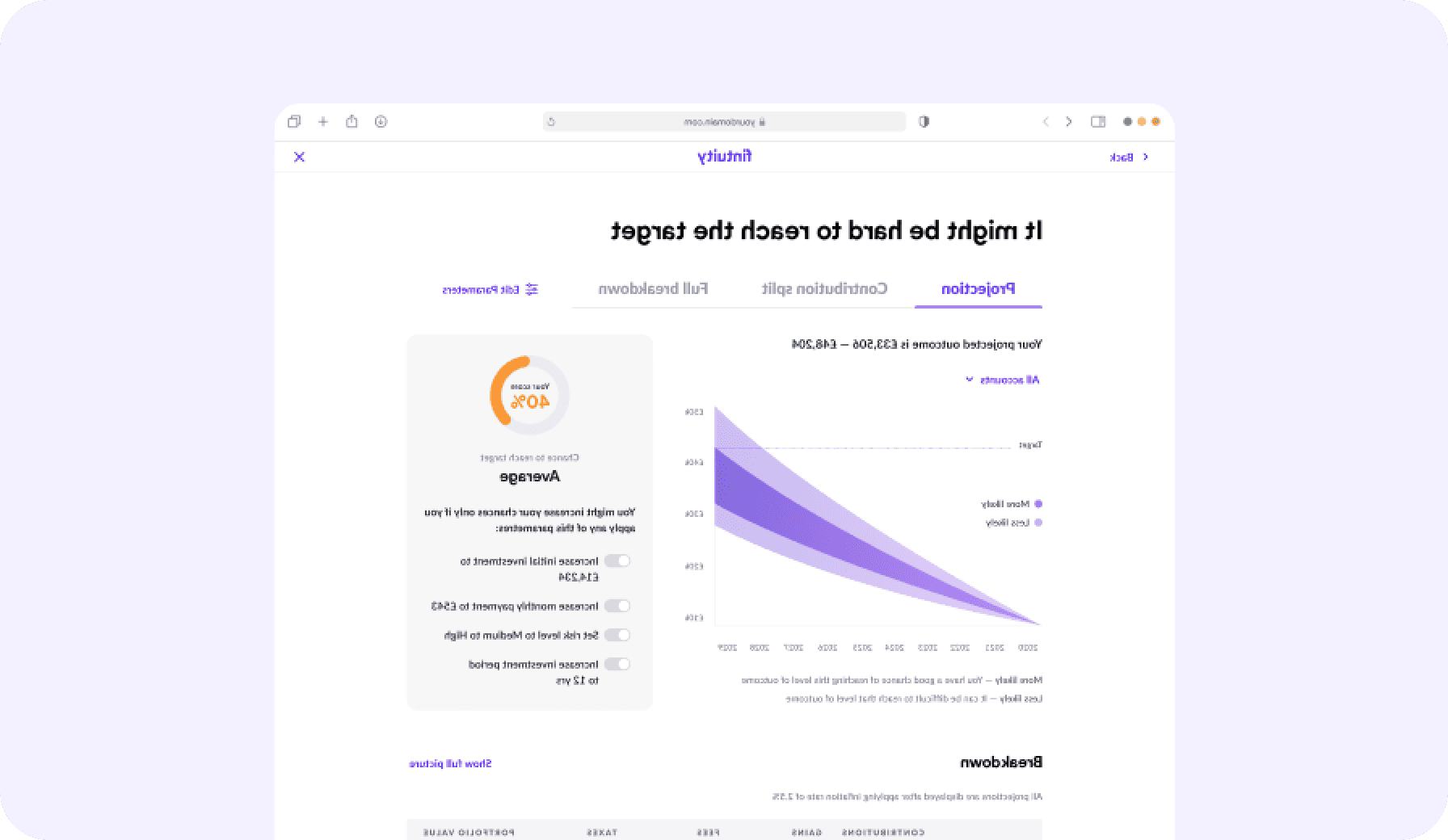

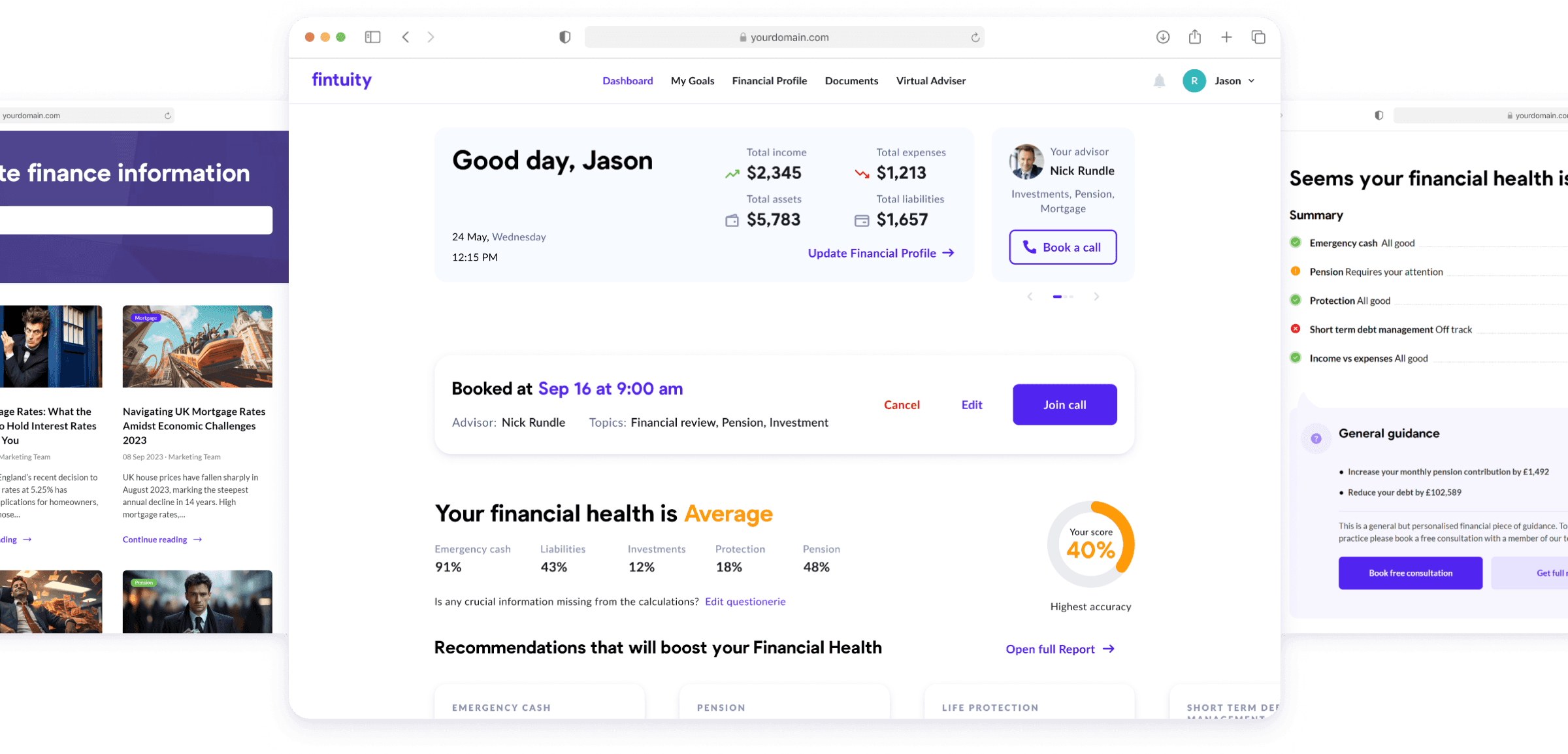

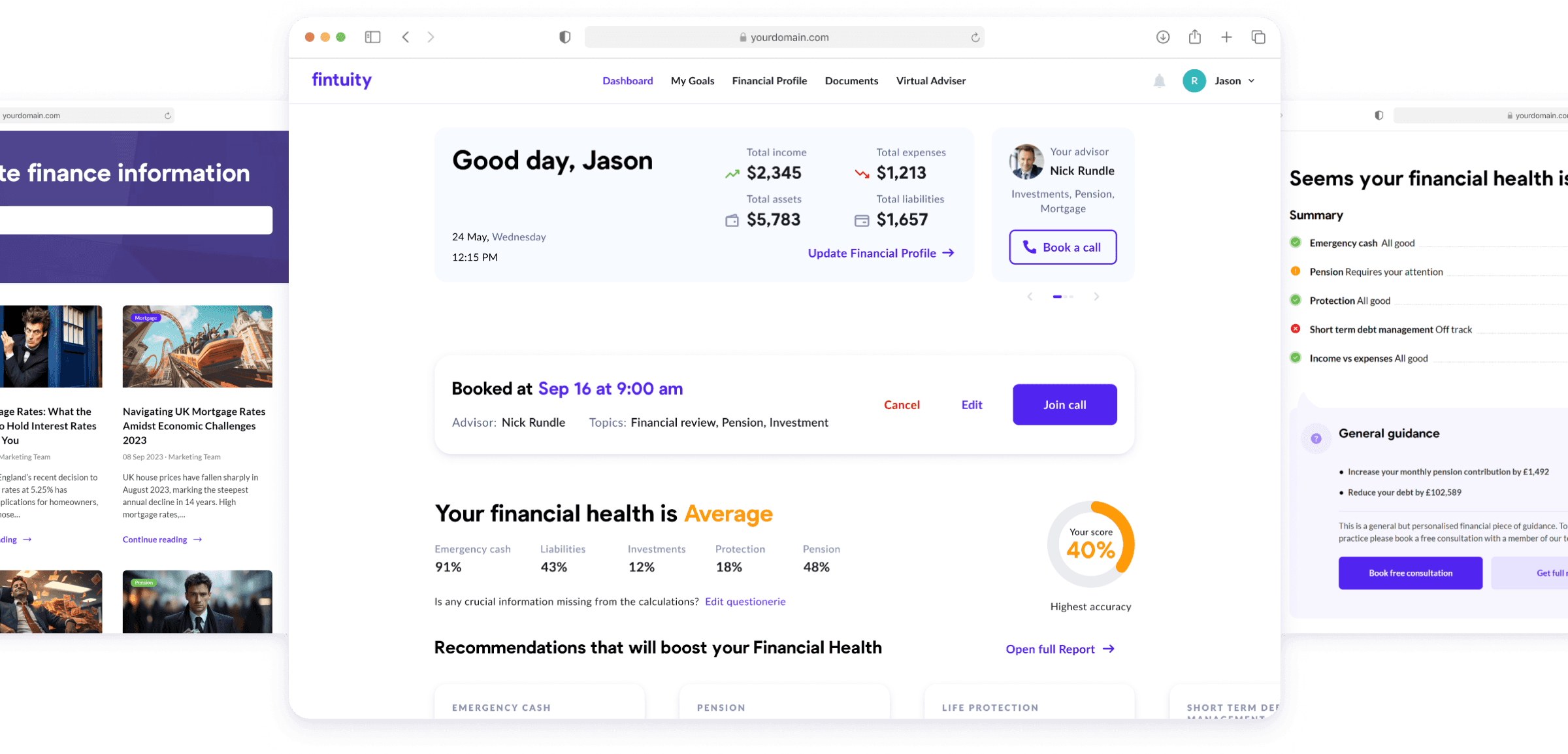

We give you access to powerful tools to help you make better money decisions.

Our coaches will create an interactive financial forecast - to help you visualise the long-term impact of decisions today and get a specific action plan for whatever your goals are.

3

Question

Can you help me with the execution of my financial plan?

ANSWER

YES

As an FCA-regulated firm, we don't just draft plans – we bring them to life. Benefit from our expert financial adviser's insider knowledge to craft, optimize, and flawlessly execute the ultimate financial strategy tailored just for you! (Provided as an additional service and priced separately)

How it works

You meet with you

own money expert

Everyone, across all levels, gets matched with your own expert for confidential video sessions.

They’ll discuss your financial goals and coach you on how to achieve those goals. Alongside quarterly check-in meetings & annual reviews your coach is always in contact when questions come up.

1

2

We give you access to powerful tools to

help you make better money decisions.

Our coaches will create an interactive financial forecast - to help you visualise the long-term impact of decisions today and get a specific action plan for whatever your goals are.

3

Question

Can you help me with the execution of my financial plan?

ANSWER

YES

As an FCA-regulated firm, we don't just draft plans – we bring them to life. Benefit from our expert financial adviser's insider knowledge to craft, optimize, and flawlessly execute the ultimate financial strategy tailored just for you! (Provided as an additional service and priced separately)

How it works

You meet with you

own money expert

Everyone, across all levels, gets matched with your own expert for confidential video sessions.

They’ll discuss your financial goals and coach you on how to achieve those goals. Alongside quarterly check-in meetings & annual reviews your coach is always in contact when questions come up.

1

2

We give you access to powerful tools to help you make better money decisions.

Our coaches will create an interactive financial forecast - to help you visualise the long-term impact of decisions today and get a specific action plan for whatever your goals are.

3

Question

Can you help me with the execution of my financial plan?

ANSWER

YES

As an FCA-regulated firm, we don't just draft plans – we bring them to life. Benefit from our expert financial adviser's insider knowledge to craft, optimize, and flawlessly execute the ultimate financial strategy tailored just for you! (Provided as an additional service and priced separately)

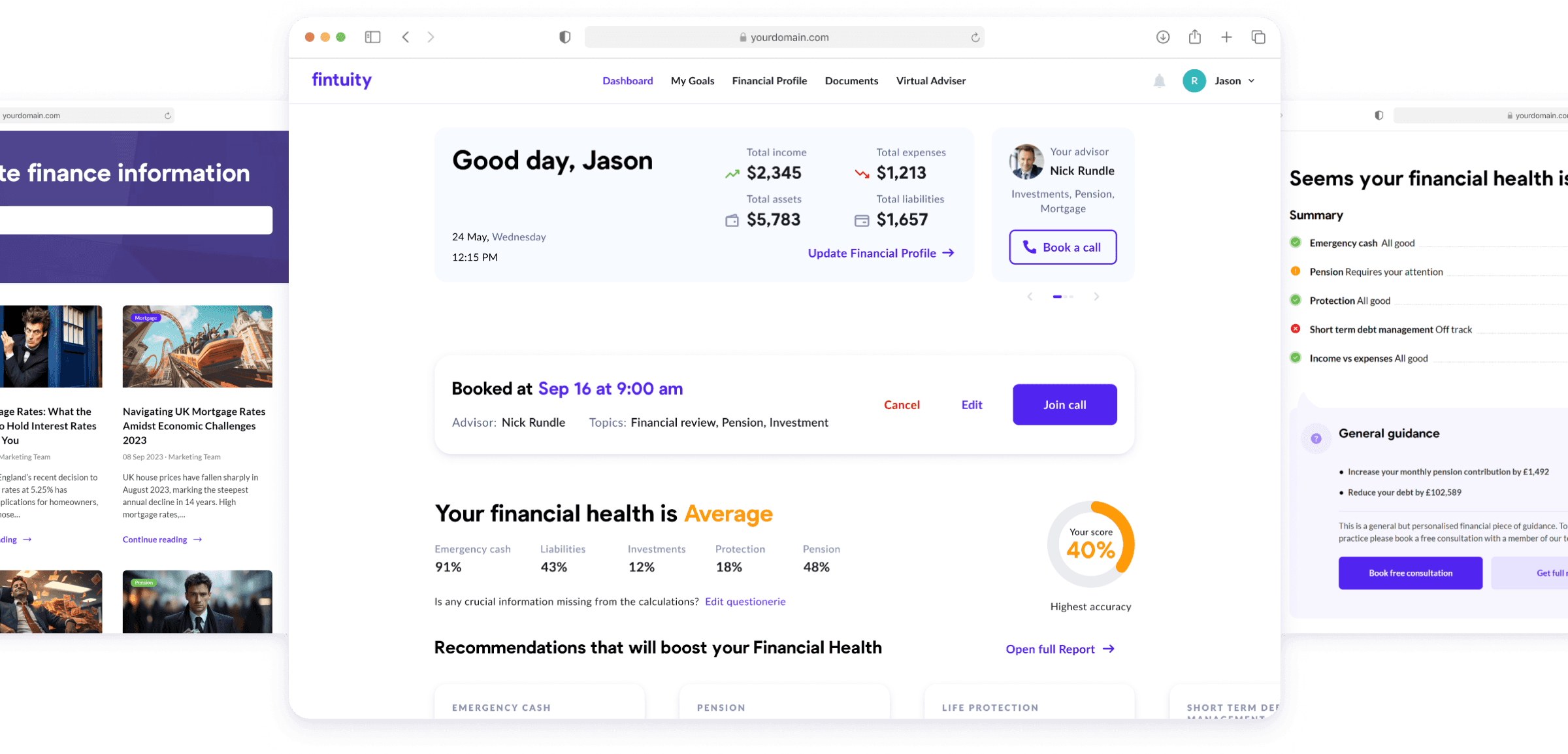

FINTUITY DIGITAL ECOSYSTEM

Navigating Between Financial Coaching

and Financial Advice

Customer profile

Financial Wellbeing

For those who want to be better with your money but don't know where to start? Unlike full financial advice, financial coaching can give you guidance on budgeting, emergency savings, and basic financial products to help you manage your finances more effectively. It allows to set the groundwork for financial advice in the future.

Regulated Financial Advice

For those considering or already holding specific financial products, such as pensions, investments, properties or life insurance may need advice tailored to these products. This includes understanding your specific tax implications, risks, and how these financial products fit into their broader financial plan.

Key features

Financial Wellbeing

• Budgeting analysis and reallocation of funds

• Benefits analysis

• Financial goals planning

• Financial Healthcheck Live-Scoring

• Virtual Adviser Access

• Webinars and Learning Resources Access

• Guidance not advice

Regulated Financial Advice

• Regulated Financial Advice

• Complex Advice

• Comprehensive product / solutions

• Independent, personalised recommendations

• Specific planning work (pensions, investments, mortgages, protection, tax planning)

• Annual suitability checks

• FCA regulated adviceClient contact points

Financial Wellbeing

• Initial Online Meeting (1 hr)

• Quarterly check-in (15 min)

• Annual one-to-one review (1 hr)

Regulated Financial Advice

• Initial Online Meeting (30 min)

• Factfinding meeting (90 min)

• Recommendation meeting (60 min)

• Annual review (60-90 min)Cost of services

Financial Wellbeing

£25 per month or £250 per annum per household

Regulated Financial Advice

Based on service need – usually a 1.5% initial and 0.5% ongoing fee for pensions and investments while commission-based (paid by provider) for mortgages and protection.

FINTUITY DIGITAL ECOSYSTEM

Navigating Between Financial Coaching

and Financial Advice

Customer profile

Financial Wellbeing

For those who want to be better with your money but don't know where to start? Unlike full financial advice, financial coaching can give you guidance on budgeting, emergency savings, and basic financial products to help you manage your finances more effectively. It allows to set the groundwork for financial advice in the future.

Regulated Financial Advice

For those considering or already holding specific financial products, such as pensions, investments, properties or life insurance may need advice tailored to these products. This includes understanding your specific tax implications, risks, and how these financial products fit into their broader financial plan.

Key features

Financial Wellbeing

• Budgeting analysis and reallocation of funds

• Benefits analysis

• Financial goals planning

• Financial Healthcheck Live-Scoring

• Virtual Adviser Access

• Webinars and Learning Resources Access

• Guidance not advice

Regulated Financial Advice

• Regulated Financial Advice

• Complex Advice

• Comprehensive product / solutions

• Independent, personalised recommendations

• Specific planning work (pensions, investments, mortgages, protection, tax planning)

• Annual suitability checks

• FCA regulated adviceClient contact points

Financial Wellbeing

• Initial Online Meeting (1 hr)

• Quarterly check-in (15 min)

• Annual one-to-one review (1 hr)

Regulated Financial Advice

• Initial Online Meeting (30 min)

• Factfinding meeting (90 min)

• Recommendation meeting (60 min)

• Annual review (60-90 min)Cost of services

Financial Wellbeing

£25 per month or £250 per annum per household

Regulated Financial Advice

Based on service need – usually a 1.5% initial and 0.5% ongoing fee for pensions and investments while commission-based (paid by provider) for mortgages and protection.

FINTUITY DIGITAL ECOSYSTEM

Navigating Between Financial Coaching

and Financial Advice

Customer profile

Financial Wellbeing

For those who want to be better with your money but don't know where to start? Unlike full financial advice, financial coaching can give you guidance on budgeting, emergency savings, and basic financial products to help you manage your finances more effectively. It allows to set the groundwork for financial advice in the future.

Regulated Financial Advice

For those considering or already holding specific financial products, such as pensions, investments, properties or life insurance may need advice tailored to these products. This includes understanding your specific tax implications, risks, and how these financial products fit into their broader financial plan.

Key features

Financial Wellbeing

• Budgeting analysis and reallocation of funds

• Benefits analysis

• Financial goals planning

• Financial Healthcheck Live-Scoring

• Virtual Adviser Access

• Webinars and Learning Resources Access

• Guidance not adviceRegulated Financial Advice

• Regulated Financial Advice

• Complex Advice

• Comprehensive product / solutions

• Independent, personalised recommendations

• Specific planning work (pensions, investments, mortgages, protection, tax planning)

• Annual suitability checks

• FCA regulated adviceClient contact points

Financial Wellbeing

• Initial Online Meeting (1 hr)

• Quarterly check-in (15 min)

• Annual one-to-one review (1 hr)Regulated Financial Advice

• Initial Online Meeting (30 min)

• Factfinding meeting (90 min)

• Recommendation meeting (60 min)

• Annual review (60-90 min)Cost of services

Financial Wellbeing

£25 per month or £250 per annum per household

Regulated Financial Advice

Based on service need – usually a 1.5% initial and 0.5% ongoing fee for pensions and investments while commission-based (paid by provider) for mortgages and protection.

Features

What is included in the Service

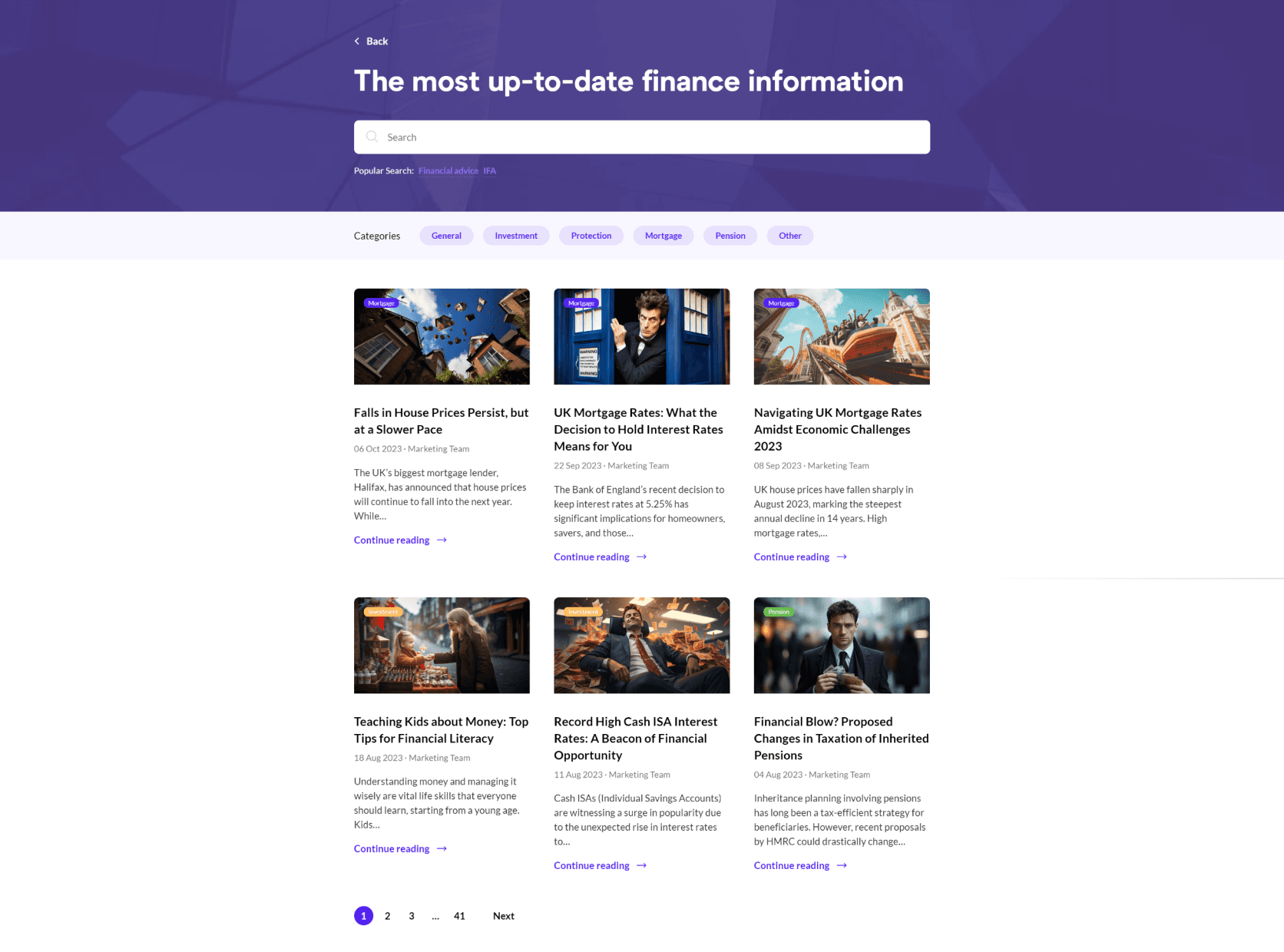

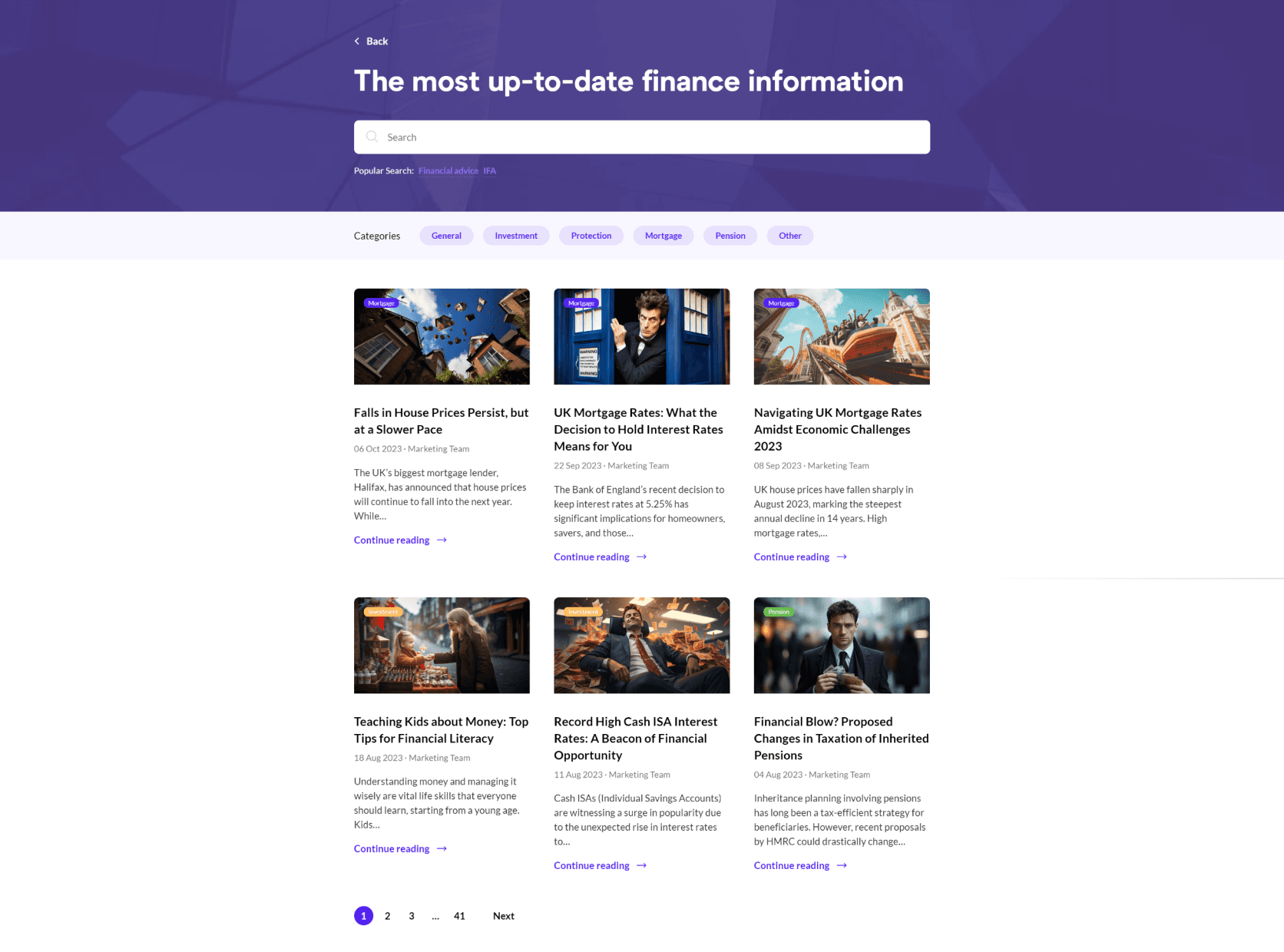

Discover the added value of our subscription with a host of additional features and products

1-to-1 regular meetings with Fintuity financial experts

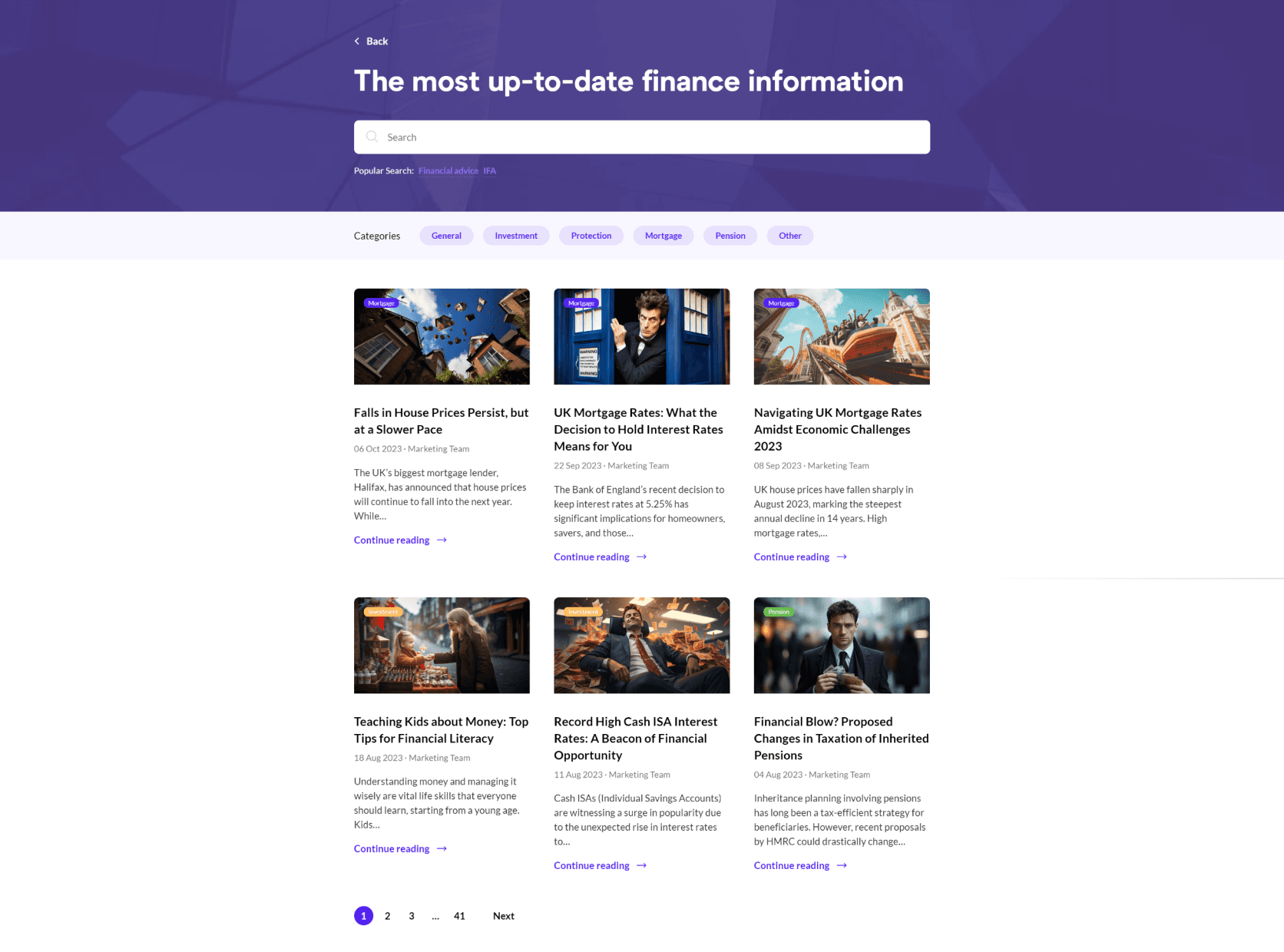

Access to our exclusive learning materials and financial articles

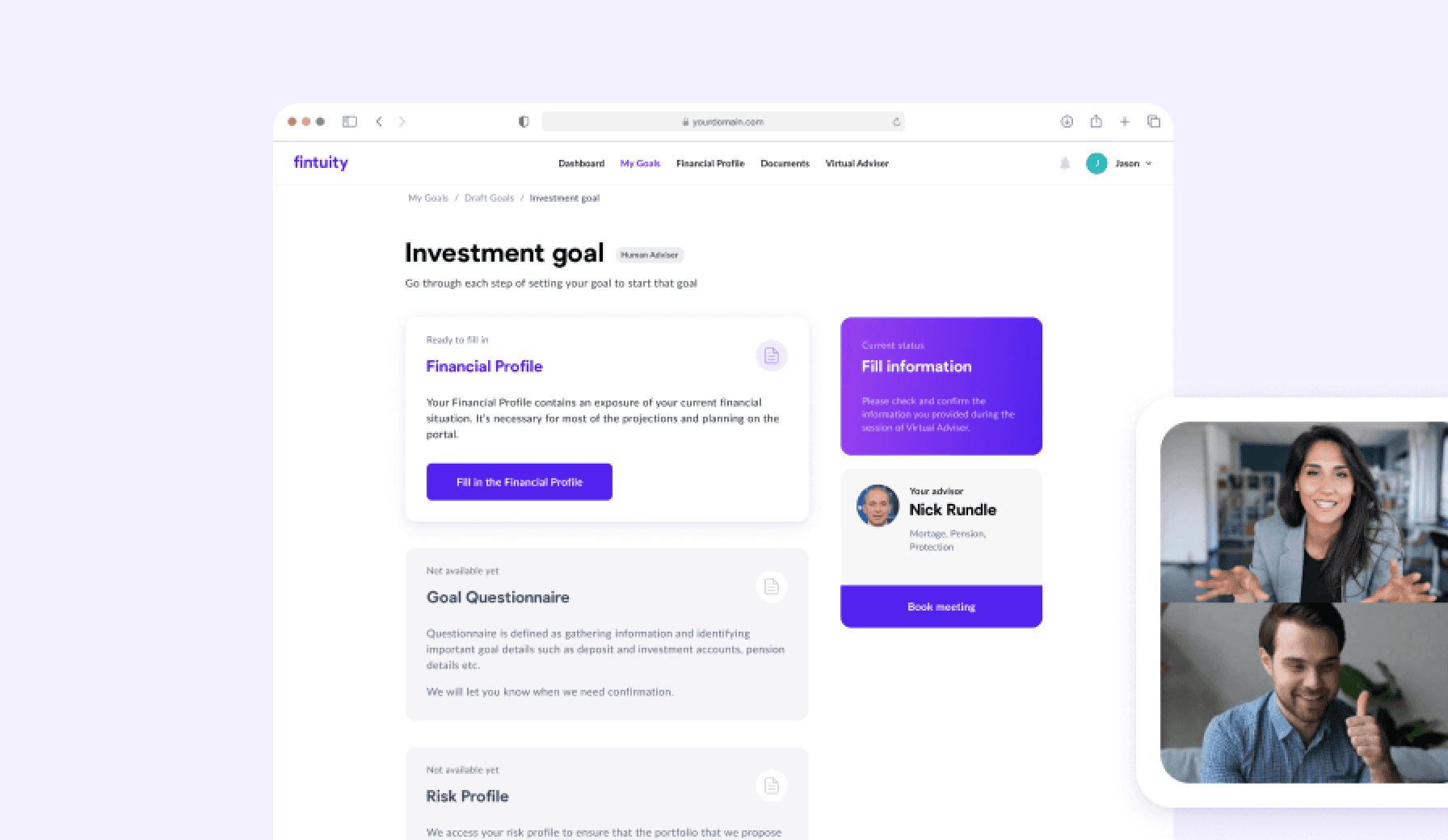

Access to Fintuity Financial Portlal

Access to Fintuity Virtual Adviser

Discover the added value of our subscription with a host of additional features and products

Features

What is included in the Service

Discover the added value of our subscription with a host of additional features and products

1-to-1 regular meetings with Fintuity financial experts

Discover the added value of our subscription with a host of additional features and products

Access to our exclusive learning materials and financial articles

Access to Fintuity Financial Portlal

Discover the added value of our subscription with a host of additional features and products

Access to Fintuity Virtual Adviser

Discover the added value of our subscription with a host of additional features and products

Features

What is included in the Service

Discover the added value of our subscription with a host of additional features and products

1-to-1 regular meetings with Fintuity financial experts

Discover the added value of our subscription with a host of additional features and products

Access to our exclusive learning materials and financial articles

Access to Fintuity Financial Portlal

Discover the added value of our subscription with a host of additional features and products

Access to Fintuity Virtual Adviser

Discover the added value of our subscription with a host of additional features and products

Our All-in-one platform helps you manage your personal finances

Our All-in-one platform helps you

manage your personal finances

Our All-in-one platform helps you manage your personal finances

Connect effortlessly with your trusted financial coach or adviser. Seamlessly set up, execute, and monitor your financial plans, and empower yourself with valuable knowledge. Plus, gain instant guidance from our Virtual Adviser, all within a single, user-friendly platform.

Why we stand out

from others

Fintuity Financial Wellbeing

Others coaching Services

Financial advisers

FCA regulated advisers

Non regulated coaches

Years of experience with clients

Not Required

FCA Fit and Proper Adviser Test Approved

Not Required

Members of Professional Bodies

Not Required

Access to our properietry client services platform

Not Required

Why we stand out from others

Fintuity Financial

Wellbeing

Others coaching

Services

Financial advisers

FCA regulated advisers

Non regulated coaches

Years of experience

with clients

Not Required

FCA Fit and Proper

Adviser Test Approved

Not Required

Members of Professional

Bodies

Not Required

Access to our properietry

client services platform

Not Required

Why we stand out from others

Fintuity Financial Wellbeing

Others coaching Services

Financial advisers

FCA regulated advisers

Non regulated coaches

Years of experience with clients

Not Required

FCA Fit and Proper Adviser Test Approved

Not Required

Members of Professional Bodies

Not Required

Access to our properietry client services platform

Not Required

fintuity products

We provide support

on all money worries

Pension planning

Make sure you are making the most of your workplace and personal pension and on track for retirement.

Protection Planning

Help you understand how to financially protect your loved ones in the event of unexpected circumstances.

Benefits guidance

Make sure you are making the most of your tax allowances and benefits due to you.

Investment guidance

Helping you navigate the various investment products available and making use of tax advantageous products.

Mortgage planning

Our qualified experts can help assess mortgage affordability and help you understand your options for home ownership.

Webinars & learning resources

Share access to our platform with live webinars, articles, guides and more

Budgeting support

Help employees feel more in control of their money with 1-to-1 help creating a household budget

fintuity products

We provide support

on all money worries

Pension planning

Make sure you are making the most of your workplace and personal pension and on track for retirement.

Protection Planning

Help you understand how to financially protect your loved ones in the event of unexpected circumstances.

Benefits guidance

Make sure you are making the most of your tax allowances and benefits due to you.

Investment guidance

Helping you navigate the various investment products available and making use of tax advantageous products.

Mortgage planning

Our qualified experts can help assess mortgage affordability and help you understand your options for home ownership.

Webinars & learning resources

Share access to our platform with live webinars, articles, guides and more

Budgeting support

Help employees feel more in control of their money with 1-to-1 help creating a household budget

fintuity products

We provide support

on all money worries

Pension planning

Make sure you are making the most of your workplace and personal pension and on track for retirement.

Protection Planning

Help you understand how to financially protect your loved ones in the event of unexpected circumstances.

Benefits guidance

Make sure you are making the most of your tax allowances and benefits due to you.

Investment guidance

Helping you navigate the various investment products available and making use of tax advantageous products.

Mortgage planning

Our qualified experts can help assess mortgage affordability and help you understand your options for home ownership.

Webinars & learning resources

Share access to our platform with live webinars, articles, guides and more

Budgeting support

Help employees feel more in control of their money with 1-to-1 help creating a household budget

Make a positive change to your financial situation today!

Make a positive change to your financial situation today!

Make a positive change to your financial situation today!

While others offer mere theories, we provide hands-on guidance to transform your employees financial dreams into tangible achievements.

FAQ

Should you have any queries about our services, fees or for any other matter please see below some of our most commonly asked questions. If you cannot find an an answer to your query please do get in touch. For more information and help please check out our Blog and Knowledge Base.

Should you decide to proceed?

Should you decide to proceed?

Should you decide to proceed?

How are you different?

How are you different?

How are you different?

What do people value the most from our service?

What do people value the most from our service?

What do people value the most from our service?

How do you control the quality of your service?

How do you control the quality of your service?

How do you control the quality of your service?

How much does it cost?

How much does it cost?

How much does it cost?

Book a free consultation

Your first consultation is completely free of

charge - all you need to do is to select a

convenient time & date and outline how we can

assist you.

Resources

Fintuity is a trading name of Fintuity Limited, registered in England & Wales - Company No. 10849933. Fintuity Limited is authorised and regulated by the Financial Conduct Authority under reference number 814106.

128 City Road, London, EC1V 2NX

+44 1274 003920

support@fintuity.com

Resources

Fintuity is a trading name of Fintuity Limited, registered in England & Wales - Company No. 10849933. Fintuity Limited is authorised and regulated by the Financial Conduct Authority under reference number 814106.

128 City Road, London, EC1V 2NX

+44 1274 003920

support@fintuity.com

Resources

Fintuity is a trading name of Fintuity Limited, registered in England & Wales - Company No. 10849933. Fintuity Limited is authorised and regulated by the Financial Conduct Authority under reference number 814106.

128 City Road, London, EC1V 2NX

+44 1274 003920

support@fintuity.com